Editorial Note: This article is written based on topic research and editorial review.

For millions of individuals across the United States, an auto loan represents a significant financial commitment, often spanning several years. Effectively managing these obligations is paramount not only for maintaining good credit but also for ensuring long-term financial stability. With institutions like Ally Financial playing a substantial role in the auto lending landscape, understanding the intricate details of making payments is not merely a convenience but a critical aspect of sound financial stewardship. This comprehensive exploration delves into the various facets of Ally auto payments, offering clarity and strategic insights to empower borrowers in their financial journey.

Editor's Note: Published on October 26, 2023. This article explores the facts and social context surrounding "ally auto payment your ultimate guide to making payments".

Unpacking Ally's Payment Ecosystem

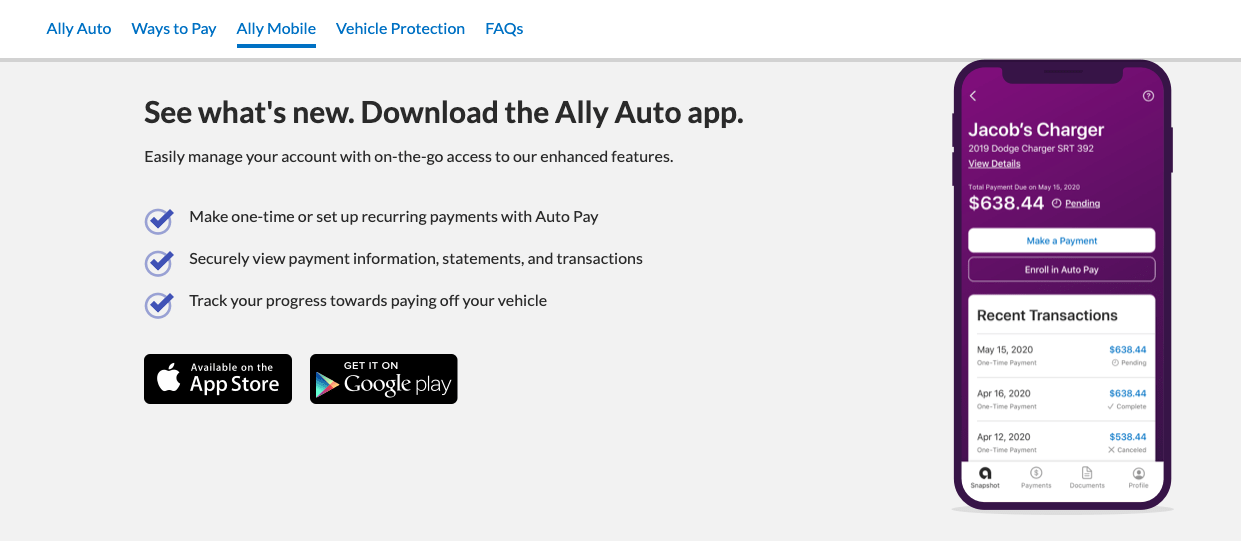

Ally Financial has developed a robust payment ecosystem designed to cater to diverse borrower preferences, ranging from traditional methods to technologically advanced solutions. Understanding each avenue is key to optimizing the payment experience. The most common and widely utilized method is online payment via Ally's official website or mobile application. This digital portal offers features such as one-time payments, recurring automatic payments (AutoPay), and the ability to view payment history and statements. AutoPay, in particular, is often lauded for its ability to eliminate missed payments and associated late fees, automatically debiting the scheduled amount from a designated bank account on the due date.

Beyond digital solutions, Ally also accommodates payments through phone, mail, and direct debit. The phone payment option typically involves an automated system or speaking with a customer service representative, offering an immediate solution for those who prefer direct interaction or require assistance. Payments sent via postal mail, while slower, remain a viable option for some, requiring careful attention to mailing times to ensure timely receipt. Direct debit, distinct from AutoPay, might involve setting up payments directly through a bank's bill pay service, offering an additional layer of control for some users. Each method carries its own set of advantages and considerations, from processing times to potential service fees, making informed selection paramount for borrowers.